Tuesday, September 30, 2008

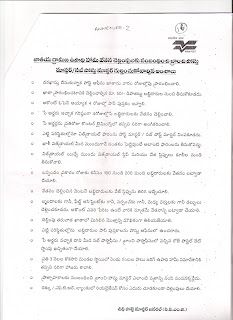

nregs information to be displayed in post offices

It is informed by the state govt that information boards of size 2 1/2' * 3' with the information given in the following images will be supplied to the post offices where nregs is being implemented. Div heads are directed to display the same at prominent places in the post offices. To view the contents of the boards please click on the following images.

RMS LSG POSTINGS

1.V.Mastanvali, BCRSA,HRO,GTL as AHRO(A/Cs),RMS’AG’Dn,Guntakal

2.B.Balaguravaiah,,SRO,Kurnool(Adhoc),as SRO,Kurnool

3.V.veerannachari,BCR SA,KNL RMS,as HSA,KNL RMS/2A

4.P.Rajareddy,BCRSA,%SRM,AG’Dn,GTL as HSA/CDP RMS/2A

5.M.Sivasankaraprasad,BCR SA,CDP RMS as Supervisor,Tirupati RMS/2A

6.Y.P.Pullaiah,BCR SA,KNL RMS as HSA,KNL RMS/2B

7.M.Nageswararao,BCR SA,%SRM,AG’Dn,GTL as HSA,ATP RMS/1

8.B.Ramasubbanna,BCR SA,SRO,Kadapa as HSA,CDR RMS/2B

9.R.Sankaraiah,BCR SA,RO,Chennai, as Record officer,Chennai

10.G.Purushotham,BCR SA,RO,Chennaia as HSA,Nellore RMS/2A

11.B.B.N.Chandran,BCR SA,Nellore RMS, as HSA,Nellore RMS/2B

12.M.Venkataswamy,BCRSA,SSRM,Hyd.sorting as Supervisor,Tirupati RMS/B

13.M.Gopal,BCRSA,SSRM,Hyd.Sorting as AHRO(A/Cs),HRO,Tirupati

14.Md.Safq.Siddiqui,BCRSA,SSRM,Hyd.Sorting as Supervisor,Nellore RMS/B

2.B.Balaguravaiah,,SRO,Kurnool(Adhoc),as SRO,Kurnool

3.V.veerannachari,BCR SA,KNL RMS,as HSA,KNL RMS/2A

4.P.Rajareddy,BCRSA,%SRM,AG’Dn,GTL as HSA/CDP RMS/2A

5.M.Sivasankaraprasad,BCR SA,CDP RMS as Supervisor,Tirupati RMS/2A

6.Y.P.Pullaiah,BCR SA,KNL RMS as HSA,KNL RMS/2B

7.M.Nageswararao,BCR SA,%SRM,AG’Dn,GTL as HSA,ATP RMS/1

8.B.Ramasubbanna,BCR SA,SRO,Kadapa as HSA,CDR RMS/2B

9.R.Sankaraiah,BCR SA,RO,Chennai, as Record officer,Chennai

10.G.Purushotham,BCR SA,RO,Chennaia as HSA,Nellore RMS/2A

11.B.B.N.Chandran,BCR SA,Nellore RMS, as HSA,Nellore RMS/2B

12.M.Venkataswamy,BCRSA,SSRM,Hyd.sorting as Supervisor,Tirupati RMS/B

13.M.Gopal,BCRSA,SSRM,Hyd.Sorting as AHRO(A/Cs),HRO,Tirupati

14.Md.Safq.Siddiqui,BCRSA,SSRM,Hyd.Sorting as Supervisor,Nellore RMS/B

Wednesday, September 17, 2008

new logo for dept of posts

new logo for the department of posts will be launched on 23rd september 2008

Friday, September 12, 2008

small savings -- frequently asked questions by custmers

FAQs on Small Savings Schemes

Q. What are the Small Savings Schemes operated through Post Offices?

Ans. Presently following savings schemes are being operated by post offices: (i) Savings Account

(ii) 5 Years Recurring Deposit Account

(iii) 6 Years Monthly Income Account

(iv) 1,2,3,5 Year Term Deposit Account

(v) 5 Years Sr. Citizens Savings Scheme

(vi) 15 Year Public Provident Fund

(vii) 6 Years National Savings Certificates (VHIth Issue)

(viii) KisanVikas Patras

Savings Account

Q. What is the current rate of interest on Savings Accounts?

Ans - 3.5 %

Q, How many Single Savings Accounts may be opened by an adult in his

own name in any one Post Office ? Ans - Only one

Q. How many adults may open a Joint Savings Account ? Ans - 2 or 3

Q. What is the minimum age for opening a Single Savings Account: by a

minor himself in his name 7 Ans -10 years

Q, How many savings accounts can be opened by a minor in his own name? Ans - Only one

Q. How many Savings Accounts can be opened by a guardian on behalf of a

minor? Ans - Only one

Q. In which form the amount for opening a Sayings ^Account can be

presented - whether by cash or cheque or demand draft.

Ans - By cash

Q. What is the fee for making nomination in a Savings Account first time?

Ans - No fee

Q. What is the fee for getting the nomination altered in a Savings Account?

Ans - One rupee

Q. In what manner the fee for getting the nomination cancelled in a Savings Account is to be paid?

Ans - A. fee of Rs.l/- shall be charged on every application for registration of a nomination or any variation in nomination or cancellation of nomination in an existing account. This will be paid in the shape of postage stamp and affixed on the application form.

Q. How many times withdrawal can be made from a Savings Account

standing at a BO in a day?

Ans - Only once

Q. How many times withdrawal can be made from a Savings Account

standing at an EDSO in a day ? Ans - Only once

Q. How many times withdrawal can be made from a Savings Account

standing at a Departmental SO in a clay ? Ans - Any number of times

Q. How many times withdrawal can be made from a Savings Account

standing a HO in a day? Ans - Any number of times

Q. Upto what amount payment order for withdrawal from a Savings

Account may be sanctioned by a Branch Postmaster? Ans -Rs. 2000/-

Q. What minimum balance should remain in a Savings Account without cheque book after withdrawal?

Ans - Rs. 50/-

Q. What minimum balance should remain in a Savings Account with cheque book facility after withdrawal?

Ans-Rs. 500/-

Q. Whether nomination facility is available in Savings Account opened in the name of a minor bv his guardian?

Ans-No

Q. Whether a guardian may appoint a messenger for making withdrawal

from the Savings Account opened by him in the name of a minor? Ans - Yes

Q. Whether it is compulsory to present the passbook on the counter of the post office at the time of making withdrawal by cheque from, a Savings Account with cheque book facility?

Ans - No

Q. What minimum amount may be withdrawn by a cheque from a cheque

Savings Account? Ans - Rs. 20/-

Q. While calculating interest in a 3r.ngle Savings Account, what may be the

maximum IBB? Ans - Rs. 1,00,000/-

Q. While calculating interest in a Joint Savings Account, what may be the

maximum IBB? Ans - Rs. 2,00,000/-

Q. By which post office annual interest is calculated in Savings Accounts? Ans - By HPO

Q. If on calculation of annual interesi in a Savings Account, the amount comes as 7 rupees 50 paise, then what interest will be added in that account?

Ans - Rs. 8 (interest rounded off to nearest rupee)

Q. After how many consecutive financial years without any transaction a Savings Account is heated as Silent Account? Ans - 3 years

Q. Whether the amounts of annual interest added in a Savings Account may be treated as transactions in that account?

Ans - No

Q. If in a Savings Account:, the balance has reached the prescribed maximum, whether it may be treated as silent account after no transaction having taken place during three consecutive financial year?

Ans - No

Q. What is the fee for issue of duplicate passbook of a Savings Account? Ans - Rs. 10/-

Q. In what manner the fee for issue of duplicate pass book of Savings Account is paid by the depositor?

Ans - Postage stamp equal to the value of the fee to be affixed on the application

Q. Which office issues duplicate passbook of a Savings Account standing at a Departmental SO? Ans - Same SO where the Account stands except single and double handed SOs. In case of RD/MIS and SCSS accounts standing at Single and Double handed SOs, duplicate passbook is issued by HPO.

Q. Which office issues duplicate passbook of a Savings Account standing at

EDSO? Ans - HO of the respective EDSO

Q. Whether a Savings Account with cheque book facility may be closed

making final withdrawal by cheque? Ans - No, application to be made in form SB-7A

Q. Who can permit closure of a Savings Account without passbook? Ans - Head Postmaster

Q. In which condition a time scale SO can close a Savings Account

independently itself? Ans - If current year's interest is not due in the Account

Q. To whom the passbook of a closed Savings Account is given? Ans - Returned to the depositor

Q. Whether a pension Savings Account may be closed itself by LSG SO by

calculating current year's interest? Ans - No, Closure is to be permitted by HO

Q. What is the fee for getting a Savings Account transferred from one post

office to another PO ? Ans - No fee

Q. Whether one of the depositors of a Joint 'B' Savings Account can get that account transferred from one post office to another by signing the application for transfer himself only ?

Ans - No, All the account holders are required to sign.

Q. Whether a Savings Account of a deceased depositor can be transferred

from one post office to another? Ans - No

Q. During what period a Savings Account can not be transferred from one

Head Post Office to another Head Post Office? Ans - From 16th March to 31st March

Q. Whether a Savings Account which has been ordered to be closed, may be

got transferred from one post office to another? Ans - No

Q. After registration of nomination in HO in a Savings Account standing at SO, in which document the intimation of registering the nomination is noted by HO and sent to SO?

Ans-In SBslip SB-27

Q. Where is nomination in Savings Accounts opened in Sub Post Office

registered? Ans - In Head Post Office

Q. Who are eligible to open Single Savings Account?

Ans.- (i) For Single Account;- Ar adult Individual and A child of

minimum 10 years ago. (ii) For joint account:-- Two or three adults.

Q. How many persons can be nominated by the deposited of a savingsaccount?

Ans.-Any number of persons can be nominated.

Q. How can a depositor of savings account be introduced? Ans.- A depositor "who desires to open savings account in post office may be introduced by one of the following modes:-

Attestation of the signature of depositor by a person known to postoffice or bank or authorities specified in this behalf.

Identification of depositor by means of photo Identity Card, RationCard, Voter Card, Passport, Driving License, CGHS Card, or any otherIdentity Card issued by a proper authority, bearing depositor'sphotograph and signature.

Identification of the depositor by a person who holds an account in thesame post office where the depositor is having his/her account.

Identification of depositor through his/her post office/SB IdentityCard.

Monthly Income Scheme

Q. What is the current rate of interest on MIS Accounts? Ans - 8%

Q. In what multiple of rupees a Monthly Income Scheme Account may be

opened ? Ans-Rs. 1500/-

Q. What is the maximum limit of investment in MIS?

Ans.- In Single account Rs.4.5 lath and i: t joint account Rs.9 lakh. Share of individual in joint account will be xh or 1/3 if the account is opened with jointly with one or two adults respectively.'While calculating limit of Rs.4.5 lakh for an individual, his/her share in all single as well as joint accounts will be added.

Q. What is the course of action if in any case it is found that investment made by an individual is in excess of maximum prescribed limit?

Ans. A declaration has to be obtained from the depositor while opening MIS account in SB-3 in manuscript that the deposits in all accounts taken together do not exceed the maximum limit. Despite tliis, if in any case, investment is found in excess of prescribed limit, a notice has to be sent to the depositor to withdraw excess amount immediately. Interest at the rate\>f savings account will be given on the excess amount from the date of opening of account till the date of issue of notice and the excess interest paid will be adjusted from the refund of excess amount.

- .

Q. What is the provision for admissibility of bonus in MIS?

Ans.- A bonus equal to 5% of the amount deposited in new accounts opened

on or after 8.12.2007 is admissible,

Q. Is there any penalty to be charged for premature closure? Ans.- From 10.2.2006, if an account is dosed after one year, a discount @ 2% of the amount invested is to be charged. If account is closed after 3 years, the rate of discount is 1%.

Senior Citizen Savings Scheme

Q. What is the rate of interest in this scheme?

Ans.- Rate of Interest in SCSS-2004 is 9% and interest is paid at the end of

each quarter of a year.

Q. What is maximum limit of investment?

Ans.- Rs.15 Lakh in multiple of Rs.1000/ -. The first depositor in joint account is the investor and there will be no share of second depositor for the purpose of limit and income tax.

Q. What are the provisions about TDS in this scheme?

Ans.- TDS at the applicable rate is required to be deducted while payment of quarterly interest if the amount of interest is more than Rs.10000/- per year. In case, a senior citizen of 65 years or above age submits declaration in form 15H, no TDS will be deducted. If the payment of interest in a year is equal or less than the Tax Exemption limit (ai present Rs.1,50,000/- for 2007-08) and depositor gives declaration in Form 15G, no TDS will be deducted.

Q. Up to which amount SCSS account can be opened by Cash? Ans.- Up to Rs.l Lakh.

Q. Up to which period a depositor can open SCSS account after receipt of

retirement benefits?

Ans.- SCSS account can be opened within one month of receipt oi retirement

benefits.

Q. Up to which date interest will be paid in case of premature closure, of SCSS account?

Ans.-Up to the date preceding the date of pi emature-dosufe. For example if premature closure is taken on 28th of a month, interest will be paid up to 27th day of that month.

Q. Is there any Income Tax Exemption in SCf JS-2004 accounts?

Ans.- Deposit under Sr. Citizen Savings Scheme qualify for deduction U/S

80-C of Income Tax Act. w.e.f 2007-08.

Q, Is there any penalty to be charged for premature closure?

Ans.- If an account is closed after one year, a discount @ 1.5 % of the amount

invested is to be charged. If account is closed after 2 years, the rate of discount

Time Deposit.

Q. What is the rate of interest offered in this scheme?Ans.- 1 Year 6.215%

Years 6.50%

Years 7.25%

Years 7.50%

Q. In what multiple of rupees a Time Deposit Account may be opened ? Ans - Multiple of Rs. 200/-

Q. Is there any Income Tax Exemption in Time Deposit?

Ans.- Deposit under 5 Years Time Deposit qualify for deduction U/S 80-C of

Income Tax Act. w.e.f 2007-08.

Post Office 5 Year Recurring Deposit

Q. For how many years an account can be opened in RD?

Ans.- This scheme is for 5 years but account can be extended up to a further

5 Years.

Q. What is the minimum amount and maximum amount that can be deposited monthly in RD account?

Ans.- An account can be opened with minimum of Rs.10/- and in multiple of Rs.5/-. There is no maximum limit.

Q. Whether a RD Account can be opened by depositing the amount by

cheque? Ans - Yes

Q. What will be the rebate on advance deposits for 6 months in a RD Account

of Rs. 10/- denomination? Ans-Rel.00

Q. What is the provision of withdrawal before maturity? -

Ans.- Withdrawal to the extent of 50% of the amount of existing balance is

permissible after one year of opening of account.

Q. When the account can be closed prematurely and what rate of interest is

permissible?

Ans. Account can be closed prematurely after three years of opening and

interest at the rate of saving;; account is admissible.

Q When a R.D. Account is treated as discontinued?

Ans.- If there are more than 4 defaults, the account will be treated as discontinued. Revival of such accounts shall be permitted only within a period of two months from the month of fifth default.

15 Years FFF

Q. What is the rate of interest in the scheme?

Ans.- Present rate of interest is 8%.

Q. What is the minimum as well as maximum amount that can be deposited in PPF account in a year?

Ans.- Minimum Rs.500/- and maximum Rs.70,000/- can be deposited in a financial year.

Q. What are the Tax benefits in flits scheme?

Ans.- Interest is completely exempted from Income Tax as per prevailing Income Tax Act provision. Subscription to PPF account qualifies for deduction u/s 80-C of I.T Act. Entire deposit in PPF account is free from wealth Tax.

6 Years NSC VIII th Issue

Q. Who can purchase 6 years NSC VIII th Issue and what is the maximum limit of investment?

Ans.- Only individual and resident of India can invest in this scheme and there is no maximum limit of investment.

Q. What is the rate of interest in this scheme?

Ans.- Interest compounded half yearly and paid at maturity. Rs.1000/-becomes Rs.160.10 on maturity.

Q. What are the Tax benefits in this scheme?

Ans.- The deposit as well as interest accruing annually but deemed to be

reinvested will qualify for deduction u/s 80-C of I.T Act.

Q. Can 6 year NSCs be transferred from one Post Office to another? Ans.- Yes

Q. What benefit is given to depositor who does not take payment after the date of maturity?

Ans.- Post Maturity Interest (PMI) is admissible on the maturity amount from the date of maturity up to maximum two years and PMI will be given at the rate of interest applicable to savings account from time to time.

Kisan Vikas Patras.

Q. What is the rate of interest in this scheme?

Ans.- Amount invested doubles in. 8 Years and 7 months.

Q. What are the Tax benefits in this scheme? Ans.- There is no tax exemption in. this scheme.

Q. Who can purchase KVPs and wnai Is the maximum limit of investment?

Ans.- Only individual and resident of India can invest in this scheme and , there is no maximum limit of investment.

Q. Can KVPs be transferred from one Post Office to another? Ans.- Yes.

Q. What benefit is given to depositor who does not take payment after the date of maturity?

Ans.- Post Maturity Interest (PMI) is admissible on the maturity amount from the date of maturity up to maximum two years and PMI will be given at the rate of interest applicable to savings account from time to time.

General

Q. What will be the collection charge or. an outstation cheque to be deposited

in any Small Savings Scheme? Ans - Rs. 30/- up to value of Rs.1000/- and beyond Rs.1000/-, Rs.3/- per

thousand or part thereof. This rate will be levied even if the cheque is/

returned uncashed.

Q. What collection charge will be levied foi depositing a local cheque in a

Savings Account? Ans - It is free

Q. If a cheque deposited in a Savings Account is dishonored by the concerned bank, then what, service charge will be recovered from the depositor ?

Ans - Rs. 50 + Postage

Q. What is the minimum denomination oi a FD Account ? Ans-Rs. 10/-

Q. How many RD Account may be opened by a person in his name? Ans - No Limit

Q. What may be the maximum denomination of a RD Account? Ans - No Limit

Q. When is the specimen signature to be verified by both the counter PA and

the SPM? Ans.- When withdrawal sought is of more than Rs.2000/-.

Q. Who are eligible to open a cheque account?

Ans.- Any literate adult individual can open s cheque account.

Q. What are the Small Savings Schemes operated through Post Offices?

Ans. Presently following savings schemes are being operated by post offices: (i) Savings Account

(ii) 5 Years Recurring Deposit Account

(iii) 6 Years Monthly Income Account

(iv) 1,2,3,5 Year Term Deposit Account

(v) 5 Years Sr. Citizens Savings Scheme

(vi) 15 Year Public Provident Fund

(vii) 6 Years National Savings Certificates (VHIth Issue)

(viii) KisanVikas Patras

Savings Account

Q. What is the current rate of interest on Savings Accounts?

Ans - 3.5 %

Q, How many Single Savings Accounts may be opened by an adult in his

own name in any one Post Office ? Ans - Only one

Q. How many adults may open a Joint Savings Account ? Ans - 2 or 3

Q. What is the minimum age for opening a Single Savings Account: by a

minor himself in his name 7 Ans -10 years

Q, How many savings accounts can be opened by a minor in his own name? Ans - Only one

Q. How many Savings Accounts can be opened by a guardian on behalf of a

minor? Ans - Only one

Q. In which form the amount for opening a Sayings ^Account can be

presented - whether by cash or cheque or demand draft.

Ans - By cash

Q. What is the fee for making nomination in a Savings Account first time?

Ans - No fee

Q. What is the fee for getting the nomination altered in a Savings Account?

Ans - One rupee

Q. In what manner the fee for getting the nomination cancelled in a Savings Account is to be paid?

Ans - A. fee of Rs.l/- shall be charged on every application for registration of a nomination or any variation in nomination or cancellation of nomination in an existing account. This will be paid in the shape of postage stamp and affixed on the application form.

Q. How many times withdrawal can be made from a Savings Account

standing at a BO in a day?

Ans - Only once

Q. How many times withdrawal can be made from a Savings Account

standing at an EDSO in a day ? Ans - Only once

Q. How many times withdrawal can be made from a Savings Account

standing at a Departmental SO in a clay ? Ans - Any number of times

Q. How many times withdrawal can be made from a Savings Account

standing a HO in a day? Ans - Any number of times

Q. Upto what amount payment order for withdrawal from a Savings

Account may be sanctioned by a Branch Postmaster? Ans -Rs. 2000/-

Q. What minimum balance should remain in a Savings Account without cheque book after withdrawal?

Ans - Rs. 50/-

Q. What minimum balance should remain in a Savings Account with cheque book facility after withdrawal?

Ans-Rs. 500/-

Q. Whether nomination facility is available in Savings Account opened in the name of a minor bv his guardian?

Ans-No

Q. Whether a guardian may appoint a messenger for making withdrawal

from the Savings Account opened by him in the name of a minor? Ans - Yes

Q. Whether it is compulsory to present the passbook on the counter of the post office at the time of making withdrawal by cheque from, a Savings Account with cheque book facility?

Ans - No

Q. What minimum amount may be withdrawn by a cheque from a cheque

Savings Account? Ans - Rs. 20/-

Q. While calculating interest in a 3r.ngle Savings Account, what may be the

maximum IBB? Ans - Rs. 1,00,000/-

Q. While calculating interest in a Joint Savings Account, what may be the

maximum IBB? Ans - Rs. 2,00,000/-

Q. By which post office annual interest is calculated in Savings Accounts? Ans - By HPO

Q. If on calculation of annual interesi in a Savings Account, the amount comes as 7 rupees 50 paise, then what interest will be added in that account?

Ans - Rs. 8 (interest rounded off to nearest rupee)

Q. After how many consecutive financial years without any transaction a Savings Account is heated as Silent Account? Ans - 3 years

Q. Whether the amounts of annual interest added in a Savings Account may be treated as transactions in that account?

Ans - No

Q. If in a Savings Account:, the balance has reached the prescribed maximum, whether it may be treated as silent account after no transaction having taken place during three consecutive financial year?

Ans - No

Q. What is the fee for issue of duplicate passbook of a Savings Account? Ans - Rs. 10/-

Q. In what manner the fee for issue of duplicate pass book of Savings Account is paid by the depositor?

Ans - Postage stamp equal to the value of the fee to be affixed on the application

Q. Which office issues duplicate passbook of a Savings Account standing at a Departmental SO? Ans - Same SO where the Account stands except single and double handed SOs. In case of RD/MIS and SCSS accounts standing at Single and Double handed SOs, duplicate passbook is issued by HPO.

Q. Which office issues duplicate passbook of a Savings Account standing at

EDSO? Ans - HO of the respective EDSO

Q. Whether a Savings Account with cheque book facility may be closed

making final withdrawal by cheque? Ans - No, application to be made in form SB-7A

Q. Who can permit closure of a Savings Account without passbook? Ans - Head Postmaster

Q. In which condition a time scale SO can close a Savings Account

independently itself? Ans - If current year's interest is not due in the Account

Q. To whom the passbook of a closed Savings Account is given? Ans - Returned to the depositor

Q. Whether a pension Savings Account may be closed itself by LSG SO by

calculating current year's interest? Ans - No, Closure is to be permitted by HO

Q. What is the fee for getting a Savings Account transferred from one post

office to another PO ? Ans - No fee

Q. Whether one of the depositors of a Joint 'B' Savings Account can get that account transferred from one post office to another by signing the application for transfer himself only ?

Ans - No, All the account holders are required to sign.

Q. Whether a Savings Account of a deceased depositor can be transferred

from one post office to another? Ans - No

Q. During what period a Savings Account can not be transferred from one

Head Post Office to another Head Post Office? Ans - From 16th March to 31st March

Q. Whether a Savings Account which has been ordered to be closed, may be

got transferred from one post office to another? Ans - No

Q. After registration of nomination in HO in a Savings Account standing at SO, in which document the intimation of registering the nomination is noted by HO and sent to SO?

Ans-In SBslip SB-27

Q. Where is nomination in Savings Accounts opened in Sub Post Office

registered? Ans - In Head Post Office

Q. Who are eligible to open Single Savings Account?

Ans.- (i) For Single Account;- Ar adult Individual and A child of

minimum 10 years ago. (ii) For joint account:-- Two or three adults.

Q. How many persons can be nominated by the deposited of a savingsaccount?

Ans.-Any number of persons can be nominated.

Q. How can a depositor of savings account be introduced? Ans.- A depositor "who desires to open savings account in post office may be introduced by one of the following modes:-

Attestation of the signature of depositor by a person known to postoffice or bank or authorities specified in this behalf.

Identification of depositor by means of photo Identity Card, RationCard, Voter Card, Passport, Driving License, CGHS Card, or any otherIdentity Card issued by a proper authority, bearing depositor'sphotograph and signature.

Identification of the depositor by a person who holds an account in thesame post office where the depositor is having his/her account.

Identification of depositor through his/her post office/SB IdentityCard.

Monthly Income Scheme

Q. What is the current rate of interest on MIS Accounts? Ans - 8%

Q. In what multiple of rupees a Monthly Income Scheme Account may be

opened ? Ans-Rs. 1500/-

Q. What is the maximum limit of investment in MIS?

Ans.- In Single account Rs.4.5 lath and i: t joint account Rs.9 lakh. Share of individual in joint account will be xh or 1/3 if the account is opened with jointly with one or two adults respectively.'While calculating limit of Rs.4.5 lakh for an individual, his/her share in all single as well as joint accounts will be added.

Q. What is the course of action if in any case it is found that investment made by an individual is in excess of maximum prescribed limit?

Ans. A declaration has to be obtained from the depositor while opening MIS account in SB-3 in manuscript that the deposits in all accounts taken together do not exceed the maximum limit. Despite tliis, if in any case, investment is found in excess of prescribed limit, a notice has to be sent to the depositor to withdraw excess amount immediately. Interest at the rate\>f savings account will be given on the excess amount from the date of opening of account till the date of issue of notice and the excess interest paid will be adjusted from the refund of excess amount.

- .

Q. What is the provision for admissibility of bonus in MIS?

Ans.- A bonus equal to 5% of the amount deposited in new accounts opened

on or after 8.12.2007 is admissible,

Q. Is there any penalty to be charged for premature closure? Ans.- From 10.2.2006, if an account is dosed after one year, a discount @ 2% of the amount invested is to be charged. If account is closed after 3 years, the rate of discount is 1%.

Senior Citizen Savings Scheme

Q. What is the rate of interest in this scheme?

Ans.- Rate of Interest in SCSS-2004 is 9% and interest is paid at the end of

each quarter of a year.

Q. What is maximum limit of investment?

Ans.- Rs.15 Lakh in multiple of Rs.1000/ -. The first depositor in joint account is the investor and there will be no share of second depositor for the purpose of limit and income tax.

Q. What are the provisions about TDS in this scheme?

Ans.- TDS at the applicable rate is required to be deducted while payment of quarterly interest if the amount of interest is more than Rs.10000/- per year. In case, a senior citizen of 65 years or above age submits declaration in form 15H, no TDS will be deducted. If the payment of interest in a year is equal or less than the Tax Exemption limit (ai present Rs.1,50,000/- for 2007-08) and depositor gives declaration in Form 15G, no TDS will be deducted.

Q. Up to which amount SCSS account can be opened by Cash? Ans.- Up to Rs.l Lakh.

Q. Up to which period a depositor can open SCSS account after receipt of

retirement benefits?

Ans.- SCSS account can be opened within one month of receipt oi retirement

benefits.

Q. Up to which date interest will be paid in case of premature closure, of SCSS account?

Ans.-Up to the date preceding the date of pi emature-dosufe. For example if premature closure is taken on 28th of a month, interest will be paid up to 27th day of that month.

Q. Is there any Income Tax Exemption in SCf JS-2004 accounts?

Ans.- Deposit under Sr. Citizen Savings Scheme qualify for deduction U/S

80-C of Income Tax Act. w.e.f 2007-08.

Q, Is there any penalty to be charged for premature closure?

Ans.- If an account is closed after one year, a discount @ 1.5 % of the amount

invested is to be charged. If account is closed after 2 years, the rate of discount

Time Deposit.

Q. What is the rate of interest offered in this scheme?Ans.- 1 Year 6.215%

Years 6.50%

Years 7.25%

Years 7.50%

Q. In what multiple of rupees a Time Deposit Account may be opened ? Ans - Multiple of Rs. 200/-

Q. Is there any Income Tax Exemption in Time Deposit?

Ans.- Deposit under 5 Years Time Deposit qualify for deduction U/S 80-C of

Income Tax Act. w.e.f 2007-08.

Post Office 5 Year Recurring Deposit

Q. For how many years an account can be opened in RD?

Ans.- This scheme is for 5 years but account can be extended up to a further

5 Years.

Q. What is the minimum amount and maximum amount that can be deposited monthly in RD account?

Ans.- An account can be opened with minimum of Rs.10/- and in multiple of Rs.5/-. There is no maximum limit.

Q. Whether a RD Account can be opened by depositing the amount by

cheque? Ans - Yes

Q. What will be the rebate on advance deposits for 6 months in a RD Account

of Rs. 10/- denomination? Ans-Rel.00

Q. What is the provision of withdrawal before maturity? -

Ans.- Withdrawal to the extent of 50% of the amount of existing balance is

permissible after one year of opening of account.

Q. When the account can be closed prematurely and what rate of interest is

permissible?

Ans. Account can be closed prematurely after three years of opening and

interest at the rate of saving;; account is admissible.

Q When a R.D. Account is treated as discontinued?

Ans.- If there are more than 4 defaults, the account will be treated as discontinued. Revival of such accounts shall be permitted only within a period of two months from the month of fifth default.

15 Years FFF

Q. What is the rate of interest in the scheme?

Ans.- Present rate of interest is 8%.

Q. What is the minimum as well as maximum amount that can be deposited in PPF account in a year?

Ans.- Minimum Rs.500/- and maximum Rs.70,000/- can be deposited in a financial year.

Q. What are the Tax benefits in flits scheme?

Ans.- Interest is completely exempted from Income Tax as per prevailing Income Tax Act provision. Subscription to PPF account qualifies for deduction u/s 80-C of I.T Act. Entire deposit in PPF account is free from wealth Tax.

6 Years NSC VIII th Issue

Q. Who can purchase 6 years NSC VIII th Issue and what is the maximum limit of investment?

Ans.- Only individual and resident of India can invest in this scheme and there is no maximum limit of investment.

Q. What is the rate of interest in this scheme?

Ans.- Interest compounded half yearly and paid at maturity. Rs.1000/-becomes Rs.160.10 on maturity.

Q. What are the Tax benefits in this scheme?

Ans.- The deposit as well as interest accruing annually but deemed to be

reinvested will qualify for deduction u/s 80-C of I.T Act.

Q. Can 6 year NSCs be transferred from one Post Office to another? Ans.- Yes

Q. What benefit is given to depositor who does not take payment after the date of maturity?

Ans.- Post Maturity Interest (PMI) is admissible on the maturity amount from the date of maturity up to maximum two years and PMI will be given at the rate of interest applicable to savings account from time to time.

Kisan Vikas Patras.

Q. What is the rate of interest in this scheme?

Ans.- Amount invested doubles in. 8 Years and 7 months.

Q. What are the Tax benefits in this scheme? Ans.- There is no tax exemption in. this scheme.

Q. Who can purchase KVPs and wnai Is the maximum limit of investment?

Ans.- Only individual and resident of India can invest in this scheme and , there is no maximum limit of investment.

Q. Can KVPs be transferred from one Post Office to another? Ans.- Yes.

Q. What benefit is given to depositor who does not take payment after the date of maturity?

Ans.- Post Maturity Interest (PMI) is admissible on the maturity amount from the date of maturity up to maximum two years and PMI will be given at the rate of interest applicable to savings account from time to time.

General

Q. What will be the collection charge or. an outstation cheque to be deposited

in any Small Savings Scheme? Ans - Rs. 30/- up to value of Rs.1000/- and beyond Rs.1000/-, Rs.3/- per

thousand or part thereof. This rate will be levied even if the cheque is/

returned uncashed.

Q. What collection charge will be levied foi depositing a local cheque in a

Savings Account? Ans - It is free

Q. If a cheque deposited in a Savings Account is dishonored by the concerned bank, then what, service charge will be recovered from the depositor ?

Ans - Rs. 50 + Postage

Q. What is the minimum denomination oi a FD Account ? Ans-Rs. 10/-

Q. How many RD Account may be opened by a person in his name? Ans - No Limit

Q. What may be the maximum denomination of a RD Account? Ans - No Limit

Q. When is the specimen signature to be verified by both the counter PA and

the SPM? Ans.- When withdrawal sought is of more than Rs.2000/-.

Q. Who are eligible to open a cheque account?

Ans.- Any literate adult individual can open s cheque account.

Thursday, September 11, 2008

workers wage account

seperate category of savings accounts for nregs workers was launched. detailed instructions alreaday circulated .div heads are directed to go thro the same and note contents

Wednesday, September 10, 2008

instructions to divisional heads reg utilisation of equipment

1. while visiting various post offices , dps kurnool has observed that valuable equipment like computers, printers are lying idle in many offices. for instance atleast 6 systems are under utilised in chandragiri h.o. In railway kodur so also, 2 or 3 pcs are found safely covered without any usage. some air coolers and printers were also found idle in some offices.div heads are directed to identify all such equipment and redeploy them to needy offices. surplus computers may be diverted to preferably single handed offices.

2. it is also noticed that some divisional heads are not visiting and taking note of the contents in this blog in spite of specific directions. all the div heads are directed to confirm that they visit this blog daily and such confirmation report should reach dps kurnool by email by 11-09-08 1800 hrs.

2. it is also noticed that some divisional heads are not visiting and taking note of the contents in this blog in spite of specific directions. all the div heads are directed to confirm that they visit this blog daily and such confirmation report should reach dps kurnool by email by 11-09-08 1800 hrs.

Thursday, September 4, 2008

acceptance of tele bills in b.o.s

it has been decided to enhance the limit from rs 1000 to rs 5000 for acceptance of tele bills of BSNL in cash at branch post offices with immediate effect

Wednesday, September 3, 2008

guidelines for engaging paid substitutes against leave/absentee gr d/postman staff

div heads should engage paid substitutes (gds) against the vacant/absentee/leave post of gr d/postman in deptl post offices having a combined staff strength exceeding four gr d/postman for a period not exceding ninety days. however the permission of head of region is mandatory if the engagement of the paid substitute against the vacant/leave/absentee postman/gr d exceeds ninety days.

unfilled dp quota vacancies of pa/sa to gds offls

aptitude test from 1000 hrs to 1100hrs on 21-09-08(sunday) followed by computer data entry test and type test for the gds candidates at 4 centers in kurnool region:

anantapur center for anantpur and hindupur divisions

kadapa center for kadapa and proddatur divisions

nandyal center for nandyal division

tirupati center for tirupati and chittoor divisions.

anantapur center for anantpur and hindupur divisions

kadapa center for kadapa and proddatur divisions

nandyal center for nandyal division

tirupati center for tirupati and chittoor divisions.

Subscribe to:

Comments (Atom)